Ask an experienced real estate investor for advice, and there’s a pretty good chance that he or she will talk about the benefits not just of real estate in general, but of multifamily investing. Many grizzled investors built their empires by starting with a multifamily property—and what’s interesting is that many of them still hold those same properties in their portfolios today.

There’s a good reason for that: investing in multifamily properties comes with a stack of advantages, and we should know—re-viv has been involved in various roles of construction and investing in this sector for over a decade.

In this article, we’ll explain the benefits of investing in multifamily properties, helping you to understand whether this form of real estate investment could be right for you.

Looking to get started with your first multifamily investment?

re-viv helps investors drive growth with actionable multifamily investment strategies. Get in touch now.

What is a Multifamily Property?

A multifamily property is a building or complex which has more than one residential unit. That means it’ll be divided, usually into a few different rental units, with a different tenant in each one. Units are traditionally self-contained, so each one will have its own kitchen, bathroom, etc., but there may also be shared amenities such as outdoor space.

That said, a hot new sector of multifamily includes co-living, where renters rent an individual bedroom in a unit and share the common areas. While this segment has actually been around for centuries, it’s growing extensively in European markets and expanding exponentially in the U.S, making these some of the best markets for multifamily investing.

When investors talk about multifamily rental properties, they’re usually talking about properties with up to four or five different units—beyond that, we start to enter the realm of commercial developers, which isn’t the focus of this article.

In some cases, a multifamily property will have an owner-occupier—that means that the owner lives on-site, and can maintain the property him or herself, usually saving on fees in the process. In other cases, the owner will live elsewhere and hire a property management company.

Many different kinds of people can live in a multifamily property—tenants might include families, working professionals, students, or retirees, for example.

For more on how investing in multifamily homes compares to single-family rentals, take a look at our in-depth guide: single-family vs. multifamily investing.

Owning direct vs. owning through an investment company

There are many ways to invest in multifamily property, but for this article we’ll focus on the two most common.

Investing directly in multifamily property means buying and maintaining a property yourself (usually with a down payment, alongside financing from a mortgage lender). It gives you the full upside when things go well, but you’ll need to take care of everything—which includes finding the right property, getting good quality tenants, and maintaining it to a good standard.

Investing in multifamily property via a fund or syndications is investing in real estate via a trusted third party, who takes investor capital, and uses it to buy one or more properties. The fund will generally take care of most of the work (such as sourcing properties and finding tenants) and will charge fees, similar to a wealth manager, in addition to a share of profits if the deal outperforms expectations.

Investing via a fund has several other advantages which we’ll cover below—and we also have a separate guide to the best multifamily investment companies.

Benefits of Multifamily Property

The focus of this article is the benefits of investing in multifamily property and in particular the pros relative to other property types. In this section, we’ll explain each of those benefits, going into as much detail as we can while still keeping it simple.

1. Consistent, steady cash flow

In general, the main reason investors like the residential real estate market is that it provides a reliable cash flow in the form of rent collected from tenants.

That rent is predictable and unlikely to change from month to month. And in a good market, it’s possible to re-lease units and replace departing tenants to maintain high occupancy levels—and therefore consistent cash flow.

2. #1 + Investing with a sponsor = Passive income

A good multifamily investment will provide passive income, in the form of monthly or quarterly cash flow from rental payments. It’s certainly true that owning any property will require some occasional work—sadly, washer/dryers break, pipes freeze and air conditioning units need replacing. But with a well-trained property management team, accompanied by a strong investment company (commonly called “asset managers”), property work is streamlined due to economies of scale.

One of the advantages to owning multifamily property via a fund manager or syndication company such as re-viv is that the income really is passive: the investment company will cover both the cost and the time investment required to upgrade and maintain a portfolio of properties.

Looking to get started with your first multifamily investment?

re-viv helps investors drive growth with actionable multifamily investment strategies. Get in touch now.

3. Lower risk than other real estate investments

All investments carry risk, and that’s certainly true of real estate. However, within this asset class, multifamily property is considered one of the least risky.

That’s partly because multifamily property provides something which underpins the US economy: people will always need comfortable, affordable housing, located near schools and their places of work. Commercial real estate on the other hand (for example retail and office buildings) is much more exposed to economic shocks.

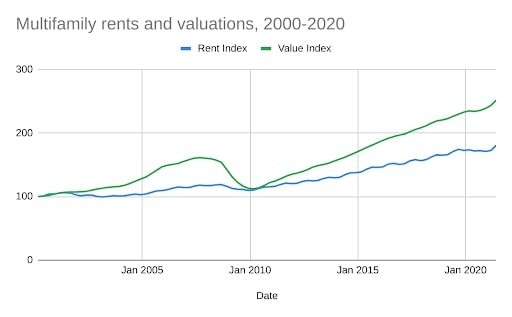

The chart below shows how multifamily real estate has performed over the last two decades. It’s worth noting that even when real estate valuations fell after the financial crash of 2008-9, rental income remained relatively robust.

Investing in multifamily housing via a fund also means that any properties in which you invest will have been screened by professionals, usually with decades of experience in real estate. This means that they can find properties that are better able to withstand downturns and can attract high-quality tenants.

One risk you’ll still need to keep an eye on if you’re investing directly—which is to say, using financing to buy a multifamily investment property—is that of rate rises. The returns you are able to generate through real estate investments are in part determined by the mortgage rates available to you which are positioned based on the Federal Reserve’s policy on setting the “Fed Rate”. When rates go up, higher mortgage interest payments eat into your net operating income, hurting your bottom line.

4. Diversification

The other factor which reduces risk is that multifamily property owners have more than one tenant. If you own a single-family home and your sole tenant decides to move to a different state for a new job, 100% of the future income from your property is dependent on your ability to source a new tenant.

If you own a small apartment building with four units, one tenant leaving just reduced your income by 25%. Whereas one tenant moving in a ten-unit building only reduces it by 10%. That’s particularly true if you have a diverse mix of tenants—for example, a retiree is less likely to move if a nearby employer shuts down.

Of course, owning multiple multifamily apartment complexes, ideally in different areas, can increase this diversification benefit even further.

5. Earn a preferred return

This one only applies to people who invest in private equity real estate funds (rather than owning direct), but it’s worth exploring.

Investors in private equity real estate funds typically earn what’s known as a preferred return. That means that they’re first in line when it comes to earning a return on their investment—so if you invest in a real estate fund or syndication that offers a preferred return of 8%, then that fund needs to pay you 8% before it takes a single cent in profit for itself.

The return that the fund needs to hit before it starts to earn a share (8%, in that example) is known as a hurdle—and over and above that hurdle, profits are split between investors and the fund itself.

That’s a significant extra protection for those who invest in multifamily residential properties via private equity investment funds such as re-viv. It’s commonly referred to as “aligning interest”; simply meaning the investment company’s payment is contingent upon performing or outperforming projections.

6. Ease of scaling

For many investors, the first multifamily property they acquire becomes the launch pad for a property empire. That’s because multifamily real estate investing is relatively easy to scale—adding a further duplex or triplex to your portfolio is much more accessible than adding an additional strip mall to your portfolio, for example.

7. Liquidity events

Investing in real estate property can also lead to liquidity events—essentially an opportunity to realize additional capital from your real estate portfolio.

If you’re able to acquire a property that goes up in value, you can get that property appraised and use that improved valuation to take on more debt against it. That means you can take a return (or, if you’re investing via a fund, that the fund can return capital to investors), in addition to rental income. Better still, very often, this capital return is not taxable.

This advantage applies to both multi and single-family properties.

8. Tax advantages

Investing in real estate provides a range of tax benefits—we won’t cover each of them here, but they include:

- The ability to deduct expenses

- Further allowances for depreciation of your property you own over time

- Capital gains taxes (rather than income taxes)

One that’s worth exploring in a little more detail is a 1031 exchange, which takes its name from Section 1031 in the IRS tax code.

This allows you to defer the tax liability when you sell an investment property, by investing the proceeds straight back into another property. Taxes can be deferred indefinitely, so long as there is no monetary benefit received from the sale of the property—which makes it an incredibly powerful way to build an investment portfolio and multiply your capital.Most recently, Opportunity Zones, which allow investors several tax benefits for the reinvestment of capital gains, have become another advantageous tax strategy.

9. Better annualized return

Real estate investments provide fantastic returns—and investing via a private equity fund (rather than a publicly listed real estate investment trust, for example) has historically increased those returns even further, with most paying an annualized return of between 10-20%.

10. Get expert advice

Investing in real estate is complex, and many new investors—and some more seasoned ones, too—get their fingers burned by entering into something without the right knowledge.

This is the advantage of investing in multifamily properties via a fund like re-viv: our team has decades of experience and access to proprietary housing market data, allowing them to carry out due diligence and source the best opportunities, where high demand for quality real estate provides consistent occupancy and stable returns for investors.

For more on this topic, take a look at our guide to analyzing multifamily investment opportunities.

11. Support local communities

Lastly, but importantly, investing in multifamily properties helps to provide safe, stable housing for America’s workforce.

At re-viv, we take this responsibility seriously, and take great pride in providing high-quality workforce housing, and go one step further, making additional investments in local nonprofits and community organizations.

By investing in multifamily properties, you can support local communities, improving the quality of life for those looking for a place to live and work.

Next steps

Investing in multifamily properties is a powerful way to build a property portfolio.

What’s more, it’s also a way to invest with purpose—ensuring that local communities have a housing supply that is affordable, well-located, and efficient.

If you’re interested in multifamily investment, you can get in touch via the contact information below, and we’ll set up a discussion and give you the information you need to get started.

Looking to get started with your first multifamily investment?

re-viv helps investors drive growth with actionable multifamily investment strategies. Get in touch now